Lamina Loans for Dummies

The 7-Minute Rule for Lamina Loans

Table of Contents6 Simple Techniques For Lamina LoansThe Main Principles Of Lamina Loans The 6-Minute Rule for Lamina LoansThe Ultimate Guide To Lamina LoansTop Guidelines Of Lamina Loans

If you're looking for a long-term lending (like over the course of the following years), a variable passion loan could not be best. When you use for a lending, you normally need a great credit rating as well as revenue to prove you're a dependable prospect for a funding. If you don't have a strong credit rating, you may require to find another person who does.A cosigner is a person who can guarantee your creditworthiness. A cosigner's credit report score can secure you a loan when you wouldn't otherwise certify. Whether you need a cosigner to qualify or otherwise, getting one can protect you a reduced rate of interest price if they have better credit score than you. While paying your funding on time can enhance your credit history (and theirs), not paying it back on time might cause your credit rating as well as theirs to go down.

Compare rates from several loan providers in 2 minutes Regarding the author Dori Zinn Dori Zinn is a student funding authority as well as a factor to Qualified. Her work has appeared in Huffington Message, Bankate, Inc, Quartz, as well as much more.

A (Lock A locked padlock) or implies you've safely attached to the. gov website. Share delicate details just on official, safe web sites.

The Basic Principles Of Lamina Loans

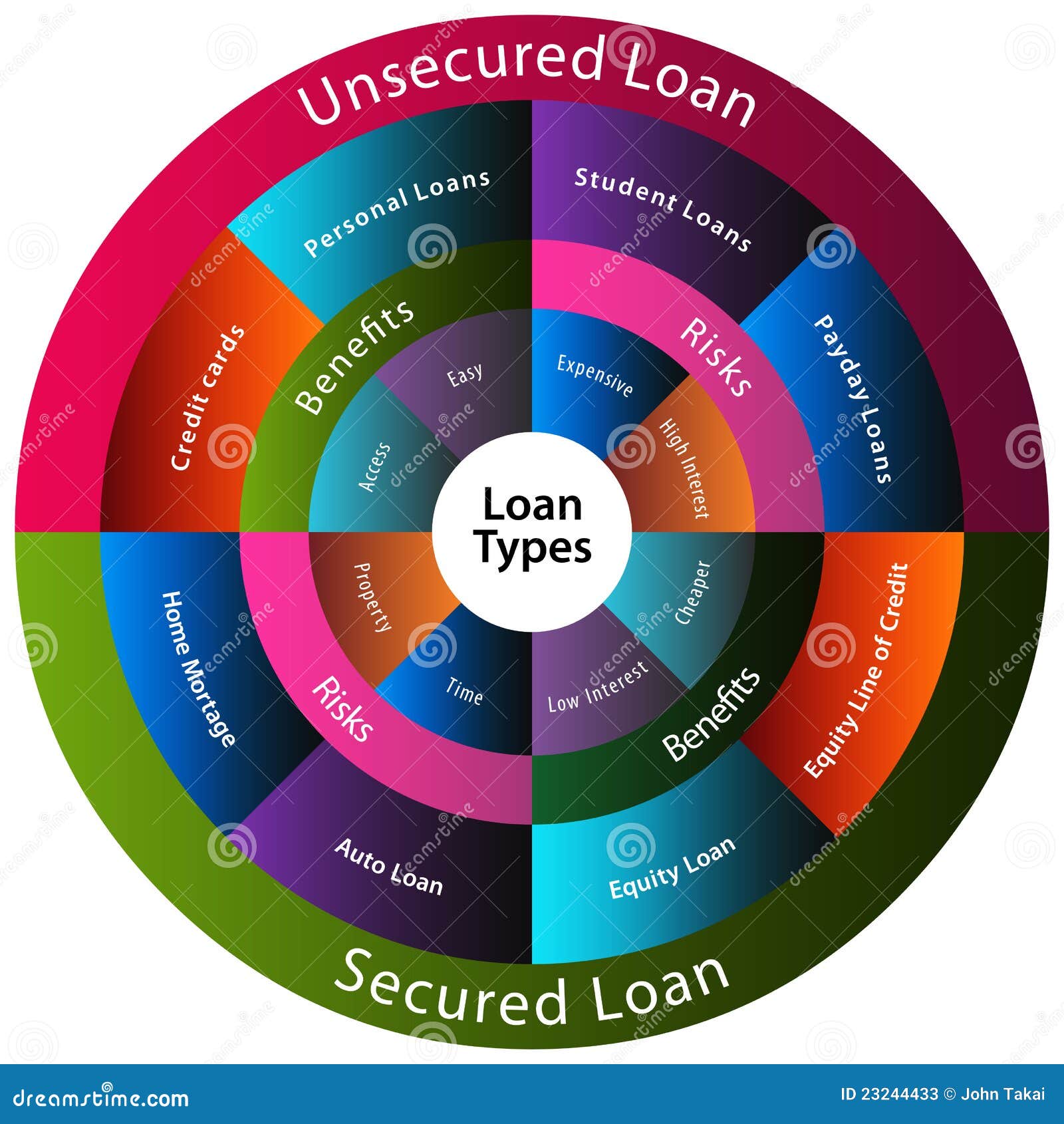

A financing is when a sum of cash is offered to an additional celebration or individual, normally including passion as well as other costs, in exchange for the future payment of the funding. When the borrower handles the lending, they concur to a set of terms that could consist of interest, money charges, in addition to repayment dates.

Car loans are a kind of financial obligation, and also lenders will certainly examine your creditworthiness, generally consisting of variables such as your credit ratings and reports, prior to supplying you a finance with its affiliated lending terms, consisting of rate of interest. The much better your credit score history, the more probable you'll be provided a lending with better terms.

Initial info about the different kinds of plastic cards readily available, covering bank card, shop cards and cost cards, as well as prepayment cards. Lamina Loans. Information about how hire purchase and also conditional sale arrangements function, the right to finish a hire acquisition arrangement and also what occurs if the purchaser is not able to pay. Points you can do to aid take care of or settle your overdraft account.

Covers credit report brokers and also the fees made for their services. Info concerning buying points from a brochure as well as being a representative for a brochure business. Info regarding what a pawnbroker is and what occurs if you are incapable to settle your financing, shed your ticket or do not collect the items.

Our Lamina Loans PDFs

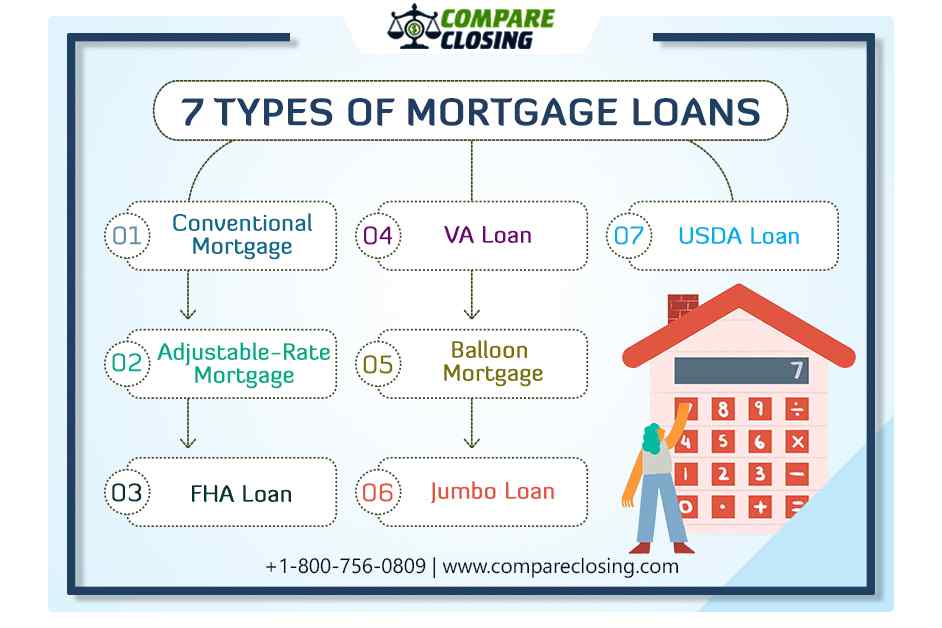

ARM lendings are usually named by the size of time the rates of interest continues to be set and also exactly how commonly the rates of interest goes through modification thereafter. In a 5y/6m ARM, the 5y stands for a first 5-year period throughout which the interest rate continues to be repaired while the 6m reveals that the rate of interest price is subject to adjustment as soon as every six months after that.

These lendings often tend to enable a reduced deposit and credit rating when contrasted to conventional loans.FHA loans are government-insured financings that could be a good suitable for property buyers with limited earnings and also funds for a down repayment. Financial Institution of America (an FHA-approved lending institution) supplies these fundings, which are guaranteed by the FHA.

Lamina Loans Things To Know Before You Buy

Peer-to-peer (P2P) financing works by matching consumers with blog loan providers through P2P borrowing platforms. These systems work like markets uniting individuals or organizations that wish to provide cash, with those that want a car loan. Relying on the platform, you may not have the very same protection as when you borrow in various other means.

A term loan is just a lending attended to organization objectives that needs to be repaid within a specified time structure. It usually carries a set rate of interest, month-to-month or quarterly settlement routine - and includes an established maturation day. Term loans can be both safeguard (i. e. some security is offered) and unprotected.

An over-limit facility is considered as a resource of short-term financing as it can be covered with the next down payment. Lamina Loans. A letter of credit scores is a file issued by a banks assuring repayment to a vendor supplied certain papers have been offered to the bank. This ensures the repayment will be made as long as the solutions are carried out (normally the dispatch of products).

Lamina Loans - Questions

At the conclusion of the leasing period, the owner would certainly have recovered a big section (or all) of the first cost of the identified possession, along with passion gained Visit Your URL from the rentals or installments paid by the lessee. The lessee also has the choice to get possession of the recognized property by, as an example, paying the last rental or installment, or by bargaining a last index acquisition price with the lessor.

This is normally a service funding provided to SMEs and are collateral-free or without 3rd celebration guarantee. Below the consumer is not needed to offer security to get the funding.

This lending facility is provided to firms with greater than 2 years of company experience, existing proprietors of at the very least 2 industrial vehicles, restricted customers as well as transporters (Lamina Loans). It is very important to note that these are just general summaries. Lenders have their particular lending evaluation and also documentation standards before a loaning decision is taken.